Financing a Roof – Know Your Options When Paying For A New Roof

- 1.Financing a Roof – Know Your Options When Paying For A New Roof

Financing a Roof:

Know Your Funding Options and Resources

When it comes to your home, investing in an excellent roof can pay dividends down the road. The benefits include extending the life of your building, saving on energy costs, bolstering property value, and ensuring the health and comfort of everyone inside. However, as such a large investment, many homeowners want to learn more about financing a roof, and the options they have when doing so. (If you want to know more about steps you can take to extend the life of your existing shingle roof, check out this article.)

“Buy once, cry once”, my Dad used to say through gritted teeth, staring down the repair bill he had just received in the mail. It was his way of reminding himself that doing an expensive project the right way — the first time — may hit the wallet harder, but it saved its fair share of tears and headaches later on.

A good roof comes at a suitable price. The average homeowner can spend in the neighborhood of $8,000 on a new installation, and sometimes more than $40,000. Unless you’re one of the lucky few with that kind of money in the bank, you’ll need to use other methods of funding. Fortunately, there are plenty of options available.

Pricing Factors

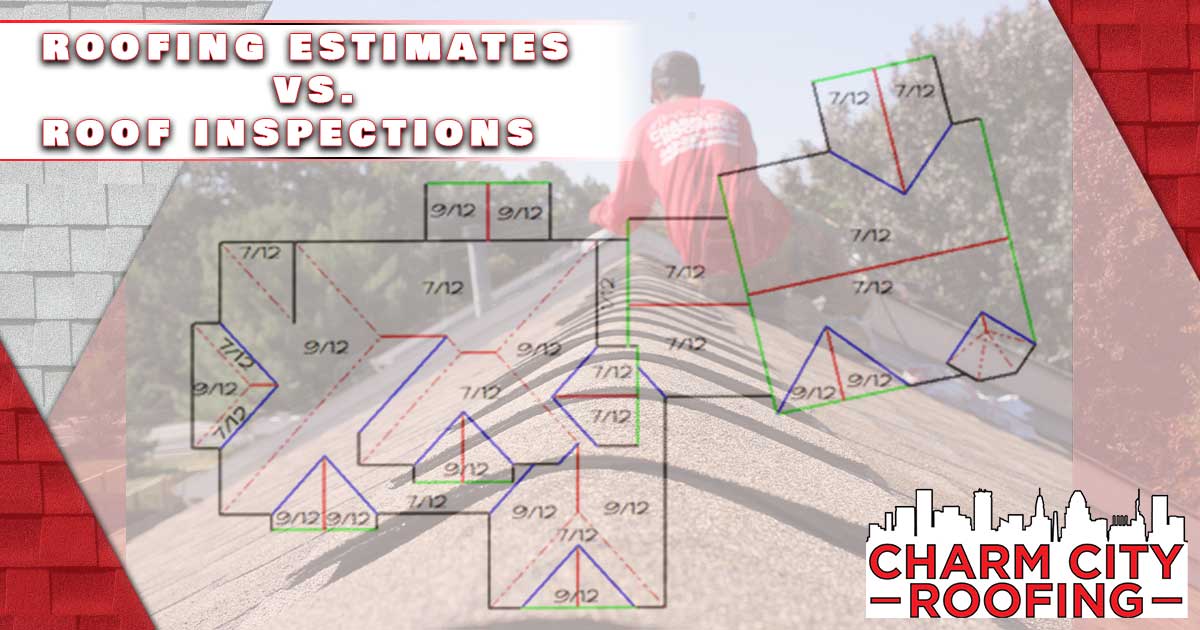

Before you even start looking at financing options, you should have an idea of what kind of cost you may be facing down. No two roofs are built exactly alike, and not all roofers charge the same rates. If you’re unsure about what services you need, you can hire a roof inspector to give you definitive answers about your project. Regardless, it’s worth taking the time to compare options in your area with the following factors in mind:

Size and material

The larger your roof, the greater the cost. The unit of measurement for a roof’s size is “squares”, with one square equaling 100 square feet. The typical roof in the United States is about 1,700 square feet, or 17 squares. It’s a good idea to know the dimensions of the roof you’re installing or replacing in advance. Certain companies may charge more for roofs with dormer windows, skylights, or other unusual features — keep that in mind as you shop.

The roofing material you choose is just as important in pricing your project as the size of the roof itself. For budget-friendly asphalt shingles, prices typically range from $2.00 to $5.50 per square foot, or $200-$550 per square, but as you explore premium shingle materials with longer lifespans like clay, slate and copper, prices may approach $2000 per square or more.

Time of year

Autumn is the most common time of year for roof installation and replacement. The temperatures are often milder and more consistent, and there’s a rush of people trying to get their housing projects finished before winter. However, scheduling a project for a quieter season, like the spring (or winter, if your local weather allows it) can mean a shorter wait, quicker work, or even a discount on the project. This depends on the company you’re using, however, so take the time to ask around.

Disposal fees

If you’re replacing an old roof, there may be costs associated with the disposal of your old roofing materials. This will usually land somewhere in the area of $900, but that price can vary widely.

Once you have a good idea of the scope and direction of your project, the best thing you can do is call and compare 3 or 4 quotes from licensed pros in your area. In addition to labor, these quotes should include removal and disposal costs (if applicable), as well as the cost of under layers like ice-and-water shield, and a workmanship warranty. Once you lay these foundations, you can begin to focus on financing.

Charm City Roofing Crew Removes layers of old shingle roof

What Are the Options for Financing A Roof?

Homeowner’s Insurance

As a common option available to almost everyone, your homeowner’s insurance is a great place to start when assessing financing. If you have a heavily damaged roof that’s covered under your policy, you could pay a fraction of the cost of the new roof. The drawback is that most policies do not cover old roofs damaged by expected wear and tear. Additionally, policies usually exclude the installation of a brand new roof as well. Contact your insurance agent to talk about plan specifics.

Company Payment Plans

It’s common for roofing companies to offer their own financing options. A customer is often able to pay these installations back over the course of several months or years. These are often a direct and simple way to pay for your roof, and can help you avoid the hassle of taking a loan from a third party. The interest rate in these plans can vary widely, however, and this interest can quickly add to the overall cost of your roof. Make sure you’re comfortable with the interest rate and monthly payment amounts, and ask about what financing options are available to you.

Home equity loans/HELOC

If your homeowner’s insurance won’t cover a roof installation, a home equity loan may be the best option for financing a roof. Banks and Credit unions let you use your home’s equity to secure a loan or line of credit (LOC). These loans and LOCs can land you with low-interest funding, fair terms, and low (or no) fees. However, there are other factors to consider. You must have built equity in your home to borrow against. In other words, you’ve paid off enough of your mortgage to create substantial difference between your home’s value and remaining mortgage debt. This difference must usually be at least 15% of the value of the home. As a result, equity options may be out of reach for newer homeowners or those without much equity. Additionally, because you are borrowing against your house, lenders can seize your home in the event of missed payments.

A home equity loan will provide you with a lump sum of funding that you must pay back in monthly installations over a certain period of time. Conversely, a home equity line of credit, or HELOC, allows you to borrow up to a specific amount in a given month (still dependent on the equity in your home). HELOCs can provide lower payments in the beginning, but may become unmanageable over time. Consider both when looking at your particular situation.

FHA Title I loans

For low- or mid-income homeowners who are unable to get a home equity loan, or are simply interested in exploring other options, the Federal Housing Administration’s (FHA’s) Title I program offers low-interest loans for the purpose of home improvement. A number of financial institutions issue the loans, and the federal government insures them. This makes FHA Title I loans a safer option for lenders. Furthermore, they are typically unsecured (meaning you don’t need to bet the house on it), if the loan is $7,500 or less. As such, FHA loans can be an excellent option for those who haven’t built equity in their home or are being held back by a low credit score.

For loans larger than $7,500, the terms are similar to a home equity loan. Your home will be held as collateral and could be seized in the case of missed payments. Additionally, Title I loans cannot exceed $25,000, so you will have to decide whether this particular loan can match the expenses of your project.

Personal Loans

Depending on your circumstances, you may find yourself needing to use a personal loan for your home improvement. The terms of these loans can differ greatly from one another, but it is possible to secure a loan that may offer lower interest rates and a more flexible plan than financing offered by the roofing company. Keep in mind, though, that the interest rates will almost certainly be higher than the loan options listed above. As always, be sure to review the terms carefully before entering any agreement.

Credit Cards

In most cases, there aren’t any advantages to using a credit card to fund a high-cost endeavor like a roof replacement. However, in some cases a credit card could provide you with a lower interest rate than any loan option available to you, especially if you take advantage of a 0% interest introductory offer. The catch is that this strategy relies on paying back the debt very quickly, as after that promotional period is over interest rates of 17% or more could strap you down. This is a last resort option.

The Bottom Line

There are several ways to make the cost of a new roof manageable and affordable. Financing a roof using contractor financing, leveraging your home equity or, in some cases, taking advantage of the FHA’s Title I program are the best and cheapest options available to those seeking to replace or install a new roof. If you exhaust those options, consider exploring credit card financing and personal loans. Always familiarize yourself with the terms and rates of your chosen plan, and compare those to your budget, before entering into any agreement.

Author: Wilden McIntosh-Round

Great read. Roof replacement is definitely very costly and requires an immediate fix. I didn’t even know there was such thing as disposable fees. It’s great that different financing options are available for those who can’t afford it. I also found this site which assists in providing roof financing options. You can check it here: https://www.roofmasterlubbock.com.